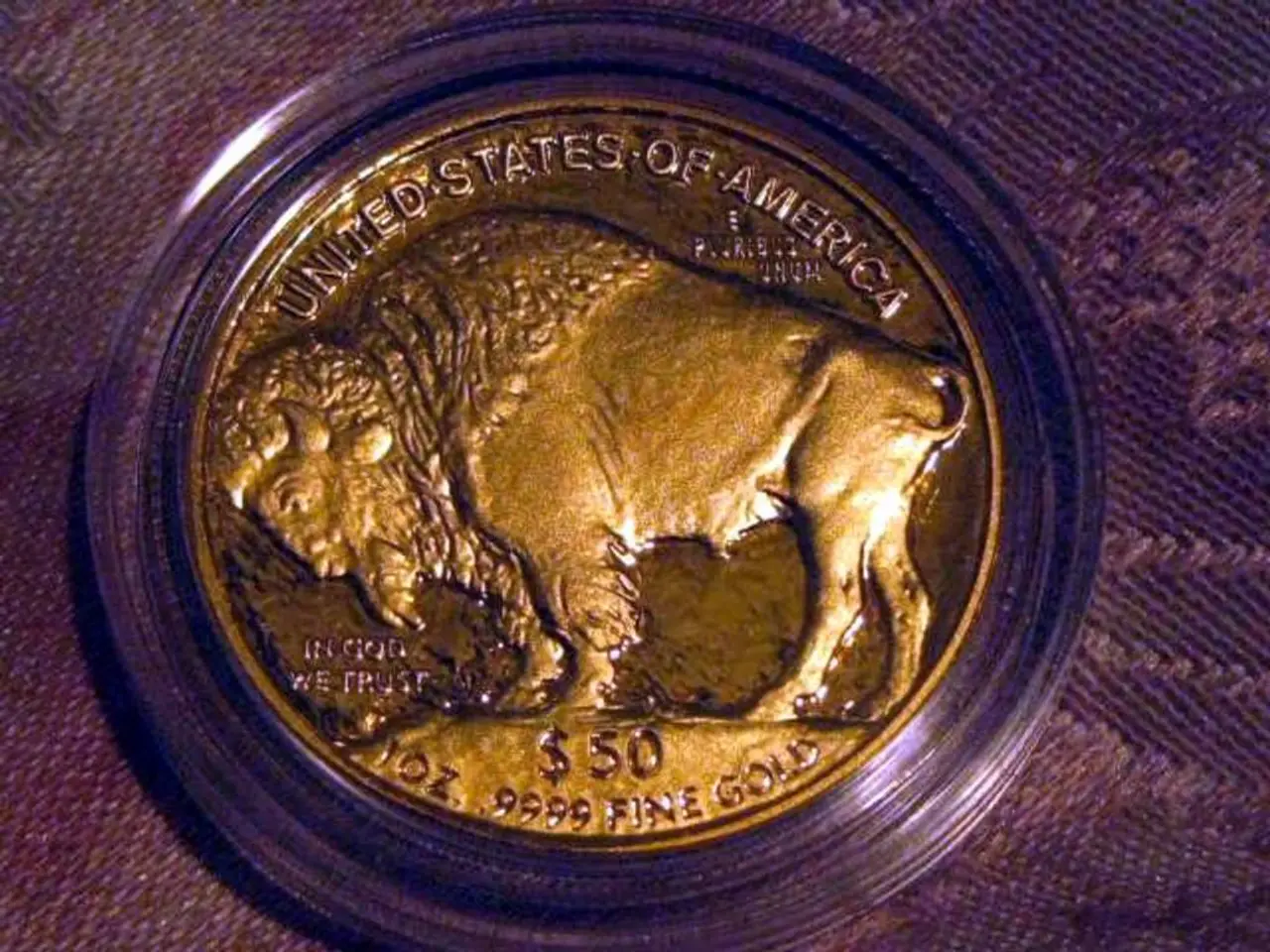

United States tariff surprise propels gold futures to new heights; equities experience a varied performance in the stock market

The White House has announced plans to issue an executive order clarifying misinformation about tariffs on gold bars and specialty products, causing a flurry in global markets. Meanwhile, the tech sector continues to grapple with the impact of ongoing tariffs, particularly in the artificial intelligence and technology sectors.

Stock Market Movements

The Nikkei 225 closed at 41,820.48, up 1.9 percent, due to relief over a tariff issue between the U.S. and Japan. The S&P 500 followed suit, closing at 6,389.45, up 0.8 percent. The Nasdaq Composite Index posted a second straight record on Friday, with the Nasdaq Composite closing at 21,450.02, up 1.0 percent.

However, the DAX closed at 24,162.86, down 0.1 percent, and the CAC 40 closed at 7,743.00, up 0.4 percent. The Shanghai Composite closed at 3,635.13, down 0.1 percent, while the Hang Seng Index closed at 24,858.82, down 0.9 percent. The FTSE 100 closed at 9,095.73, down 0.1 percent. West Texas Intermediate remained flat at $63.88 per barrel, and Brent North Sea Crude was up 0.2 percent at $66.59 per barrel.

Tariff Effects on Tech Giants

The current U.S. trade policy, marked by increased tariffs, is significantly impacting tech giants like Apple, Nvidia, and Alphabet (Google's parent). Tariffs of up to 30% have been imposed or threatened on imports from countries like China, Japan, South Korea, Malaysia, and potentially the EU, affecting key tech supply chains.

Apple faces challenges due to tariffs affecting supply chains in countries such as China and Malaysia, where components and manufacturing are significant. Specific direct tariffs on Apple models are less clear from current data.

Nvidia benefits from a partial exemption: President Trump announced that companies committed to manufacturing semiconductors in the U.S. can avoid the planned 100% tariffs on chips. Nvidia has committed to producing $500 billion of AI infrastructure in the U.S., insulating itself from tariffs and boosting investor confidence, as reflected in stock price gains.

Alphabet (Google) does not have reported explicit tariff exemptions or penalties but is indirectly affected through supply chain components and tariff-related economic uncertainty. However, Alphabet and other Big Tech companies are increasing capital expenditure substantially in 2025, partly to mitigate tariffs' economic impacts. Their massive spending on AI and data centers helps offset some tariff-related costs, supporting growth and job creation despite the uncertain trade environment.

Legal Challenges and Uncertainties

Legal challenges to the tariffs are ongoing, with some courts striking down tariffs imposed under certain authority but temporary stays allowing continuation pending appeals. Tariffs have increased economic uncertainty, but Big Tech’s aggressive investment strategies play a mitigating role on the sector's growth and on broader market stability.

Section 232 and Section 301 investigations and tariffs related to digital trade, electronic payment services, polysilicon, and copper derivatives could further complicate the tech sector's landscape.

Conclusion

While U.S. tariffs increase costs and supply chain complexity for tech giants like Apple, Nvidia, and Alphabet, Nvidia benefits from substantial tariff exemptions tied to U.S. manufacturing commitments. Apple and Alphabet mitigate tariff effects through massive capital investments, especially in AI and data infrastructure. Legal and policy uncertainties remain, making the trade environment challenging but manageable through strategic spending and domestic investment.

Elsewhere, the dollar/yen rate is up at 147.79 yen from 147.14 yen, and the pound/dollar rate is up at $1.3451 from $1.3444 on Thursday. The euro/dollar rate is down at $1.1643 from $1.1666, and the euro/pound rate is down at 86.54 pence from 86.77 pence. Apple won 4.2 percent, its third straight significant gains.

- Investors are keenly watching the financial implications of the ongoing tariff disputes, particularly in the tech sector, as tech giants like Apple, Nvidia, and Alphabet wrestle with supply chain complexities and potential tariffs on key components.

- The stock market landscape is being shaped by the interplay of tariff policies, investment strategies, and technology, with companies like Nvidia leveraging tariff exemptions through domestic manufacturing commitments, while Apple and Alphabet mitigate the impacts through substantial capital investments in AI and data infrastructure.