South Carolina withdraws the Coinbase staking lawsuit and proposes a Bitcoin Reserve Act.

In a significant move towards embracing cryptocurrency, South Carolina has seen a double whammy of legal and legislative developments that could position the state as a hub for digital asset innovation.

Last week, a lawsuit against Coinbase, a leading cryptocurrency exchange, was dismissed in South Carolina. This decision reflects a judicial environment that is not hostile to cryptocurrency businesses, creating a more favorable operational climate for crypto companies in the state. The specific details of the lawsuit dismissal are not publicly disclosed.

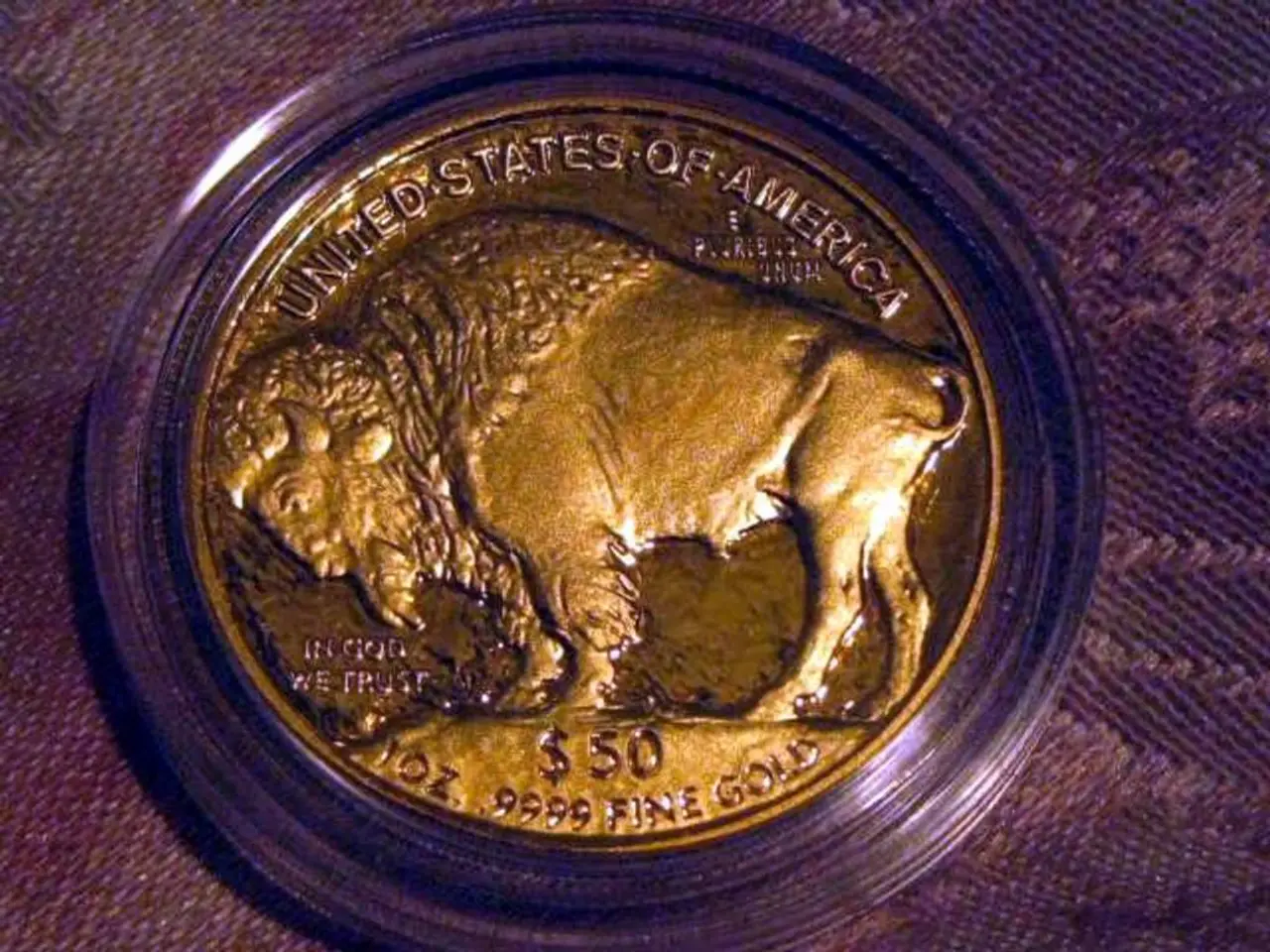

Simultaneously, state representative Jordan Pace introduced the "Strategic Digital Assets Reserve Act of South Carolina." If passed, this legislation would allow the state treasurer, Curtis Loftis, to establish a Bitcoin reserve with a maximum capacity of 1 million Bitcoin. The treasurer would be able to allocate up to 10% of certain state funds, specifically mentioning the General Fund, Budget Stabilization Reserve Fund, and other investment funds managed by the treasurer's office, to cryptocurrencies, specifically Bitcoin.

Senator Tim Scott, a key figure in federal crypto reform, is co-sponsoring bills that streamline regulation and promote innovation. Notable examples include the GENIUS Act for stablecoins and the Digital Asset Market Clarity Act, which aim to regulate digital assets with enhanced transparency, reserve requirements, and anti-money laundering rules. These federal initiatives position the U.S. as a global crypto leader.

The simultaneous lawsuit dismissal and introduction of a Bitcoin reserve bill in South Carolina may signal a shift in the state's approach to cryptocurrency, moving from regulatory action against crypto services toward potential adoption of digital assets in its financial planning.

This development comes amidst increased interest in cryptocurrency as a state-level asset. According to Bitcoin Law, 42 Bitcoin reserve bills have been introduced at the state level across 19 states, with 36 bills remaining active.

Meanwhile, Coinbase continues its expansion efforts, hinting at potentially acquiring crypto exchange Deribit and preparing to re-enter the Indian market after receiving regulatory approval from India's Financial Intelligence Unit. However, eight other states, including California and Illinois, still have similar lawsuits active against Coinbase.

Staking services are now live again in South Carolina across all Coinbase platforms, including the app and website. It is worth noting that the dismissal of the lawsuit against Coinbase related to staking services occurred on March 27, 2025, and the "Strategic Digital Assets Reserve Act of South Carolina" has not been passed into law yet.

These developments indicate South Carolina’s commitment to becoming a welcoming hub for cryptocurrency innovation with coordinated efforts at both state and federal levels. As more states reconsider their stance on digital assets, the landscape for cryptocurrency in the United States continues to evolve, with South Carolina's dual actions potentially serving as a model for other states looking to balance regulation with innovation in the cryptocurrency space.

- South Carolina's dismissal of a lawsuit against Coinbase, a leading cryptocurrency exchange, reflects a favorable judicial environment for cryptocurrency businesses in the state.

- In a remarkable move, state representative Jordan Pace introduced the "Strategic Digital Assets Reserve Act of South Carolina," which, if passed, would allow the state treasurer to establish a Bitcoin reserve with up to 1 million Bitcoin.

- Senator Tim Scott, a key figure in federal crypto reform, is co-sponsoring bills to streamline regulation and promote innovation in the cryptocurrency sector, such as the Digital Asset Market Clarity Act.

- As more states reconsider their stance on digital assets, South Carolina's dual actions – a favorable judicial climate and potential adoption of Bitcoin in its financial planning – could serve as a model for other states looking to balance regulation with innovation in the cryptocurrency space.