Regulatory Sandbox Introduced by Nigeria's SEC for Cryptocurrency Businesses

The Nigerian Securities and Exchange Commission (SEC) has been actively regulating Virtual Asset Service Providers (VASPs) under the Investment and Securities Act (ISA) 2024/2025, which officially recognizes virtual assets—including cryptocurrencies, stablecoins, NFTs, and utility tokens—as securities. This legislation requires all exchanges, wallets, and decentralized finance (DeFi) platforms to obtain licenses from the SEC to operate legally in Nigeria.

Recent changes and regulatory environment highlights include:

- Formal Classification and Licensing: The 2024 ISA explicitly classifies virtual and digital assets as investments and securities, requiring VASPs to be licensed by the SEC, thereby bringing exchanges, custodial wallets, and DeFi platforms under SEC oversight.

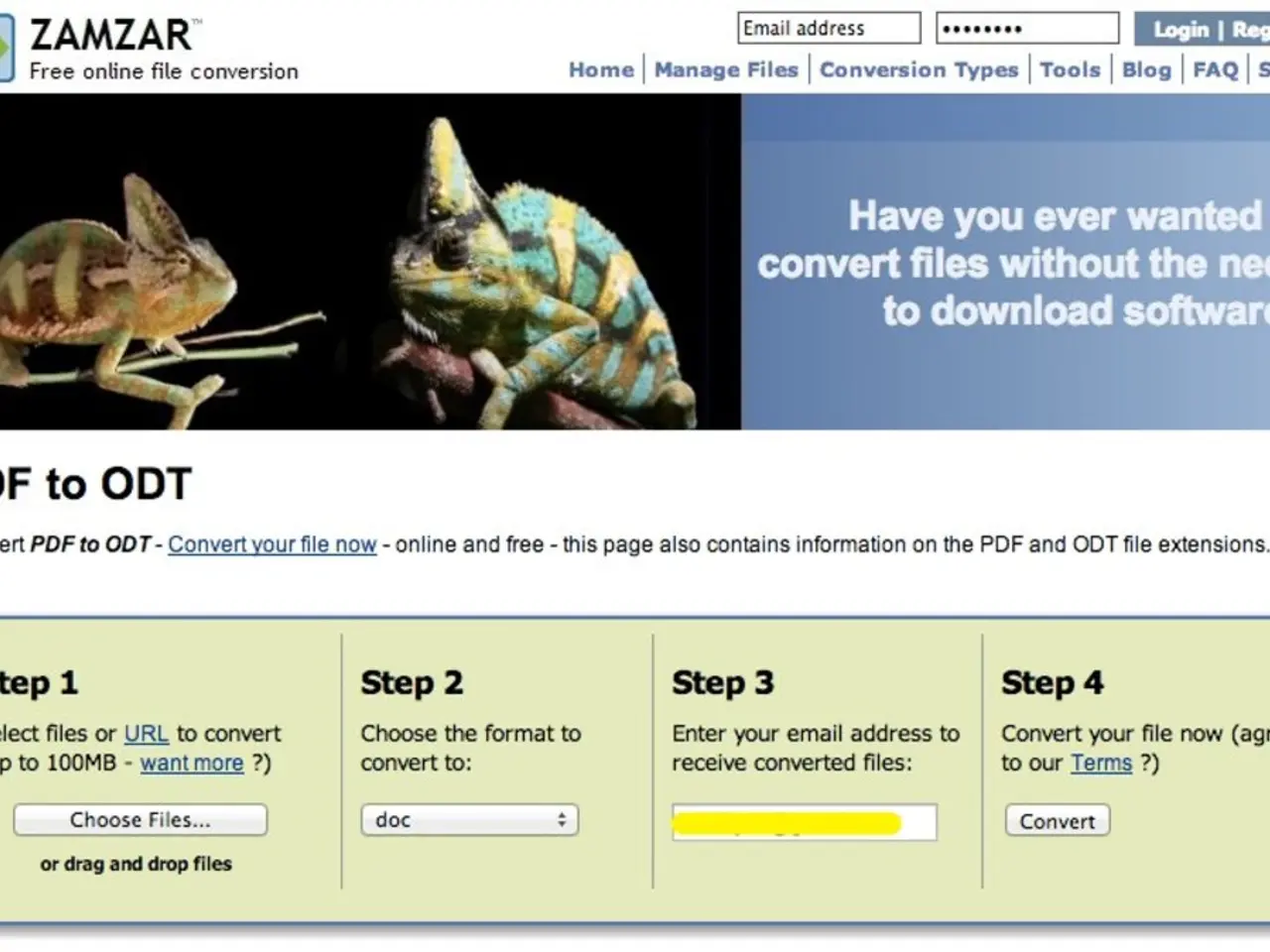

- Regulatory Sandbox and Stablecoin Acceptance: The SEC has onboarded several firms, particularly in the stablecoin sector, through a regulatory sandbox, indicating an openness to stablecoin businesses, provided they comply with local regulatory standards that emphasize market protection and risk management.

- Technological and Enforcement Enhancements: The SEC has established a dedicated Fintech and Innovation Department to maintain active dialogue with industry stakeholders and adapt regulations as the market evolves. It’s also preparing to deploy Artificial Intelligence and blockchain analytics tools to track illicit transactions and combat fraudulent schemes such as Ponzi operations, as exemplified by the collapse of CBEX.

- Regional Coordination Efforts: The Nigerian SEC, led by Director-General Dr. Emomotimi Agama, has called for harmonized regulation across West Africa. He advocates for a unified ECOWAS-wide VASP licensing system to prevent regulatory arbitrage, whereby traders banned in one country relocate operations to another.

In light of these developments, the SEC has set a N20 million (approximately $13,500) fine for any VASP operating without registration. It has also granted interim approval to VASPs registered under the Accelerated Regulatory Incubation Program (ARIP), pending the enforcement of its digital asset rules. The SEC hopes that the companies registered under ARIP will smoothly transition into formal registration when the time expires.

However, registration under ARIP does not automatically transfer to full licensing, according to the SEC. VASPs must fulfill certain conditions before registration under ARIP, and the SEC has given a 30-day ultimatum for registration. The processing fee for registration under ARIP is N2,000,000 (approximately $1,350).

In a virtual meeting with players in the crypto ecosystem in Nigeria, the SEC's new director general, Dr. Emomotimi Agama, hinted at a plan to ban the naira from all peer-to-peer exchanges. This proposal comes as the Nigerian government has been clamping down on crypto assets as it battles a rapidly devaluing currency and inflation.

In a surprising turn of events, last December the Central Bank of Nigeria issued a directive permitting banks to open accounts for crypto companies. However, the National Security Adviser (NSA) classified crypto trading as a national security threat and directed four fintech startups in Nigeria to block accounts trading in crypto and report them to law enforcement.

The SEC's recent actions underscore its commitment to maintaining a secure and transparent digital asset market in Nigeria while fostering innovation and growth. The emphasis on regional collaboration and advanced surveillance also reflects the growing need to mitigate cross-border crypto-related financial crime risks.

- The Nigerian Securities and Exchange Commission (SEC) has classified virtual and digital assets as investments and securities, placing exchanges, custodial wallets, and DeFi platforms under SEC oversight.

- The SEC has been actively collaborating with firms in the stablecoin sector through a regulatory sandbox, promoting local compliance with standards that emphasize market protection and risk management.

- The SEC has established a Fintech and Innovation Department to maintain dialogue with industry stakeholders and adapt regulations as the digital asset market evolves, while preparing to deploy AI and blockchain analytics tools for regulatory enforcement.

- The SEC's new director general, Dr. Emomotimi Agama, has hinted at a potential ban of the naira from peer-to-peer exchanges, reflecting the Nigerian government's efforts to combat cryptocurrency-related financial crimes and stabilize the national currency.