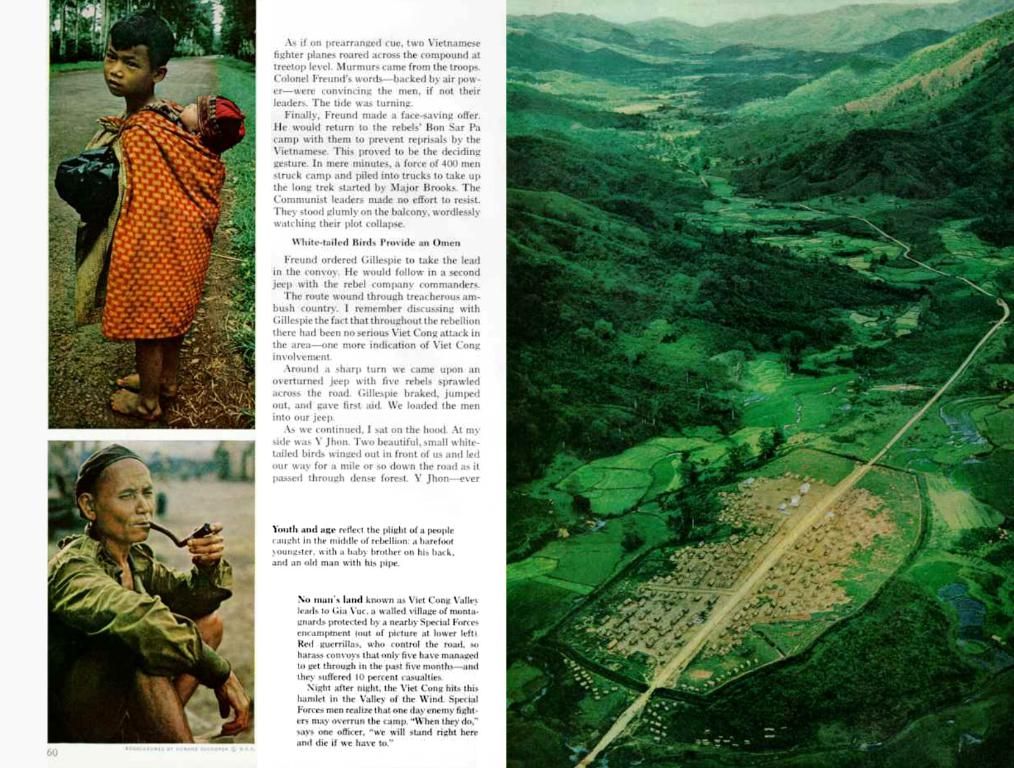

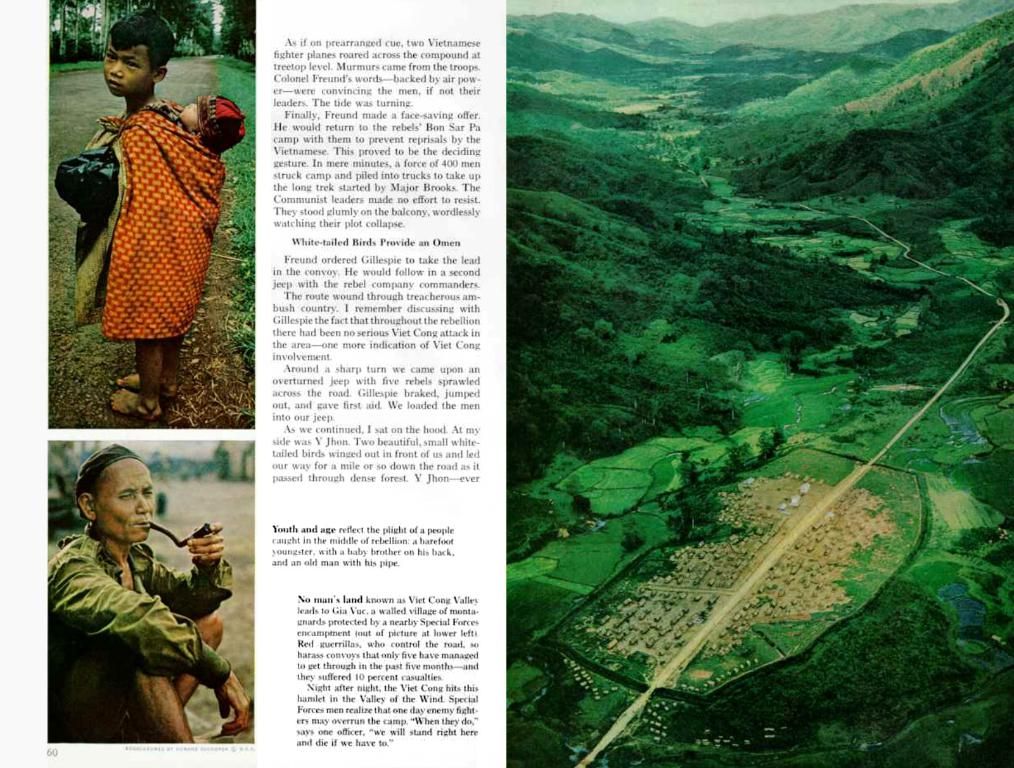

Raw materials experiencing potential significant price surges: New focus on these elements instead of gold.

Investors are keeping a close eye on the gold market in 2025, but it's silver and copper that might steal the show. After an impressive 27% return for gold in 2024, these lesser-known commodities could offer even better prospects.

The reason behind this optimism lies in the relocation of these metals to the USA due to tariff fears under a Trump administration. This mass transfer has created a huge gap between physical prices and futures prices. Normally, traders and hedge funds would swoop in to profit from such market inefficiencies, but in 2023, that wasn't the case. A copper price squeeze due to the growing price difference led to a temporary explosion in the industrial metal's price. Some experts are predicting the same for silver, with TD Securities strategist Daniel Ghali warning, "The market is currently sleepwalking towards a squeeze."

So, if you're looking to make a name for yourself among commodity investors in 2025, consider silver and copper instead of gold. For those who prefer not to hold the metals physically, there are listed vehicles available such as:

Silver: WisdomTree Physical Silver (WKN: A0N6XJ)Copper: WisdomTree Copper (WKN: A0KRKR)

For a visual representation of the trends, check out TradingView.

Here's the lowdown on silver and copper predictions and strategies:

Silver Predictions and Strategies

The World Silver Survey 2025 predicts a slight increase in silver production, primarily as a byproduct of gold mining. While silver prices might not skyrocket in 2025, demand forecasts vary, with solar demand being a significant factor. Investors may want to focus on silver's potential as a store of value and industrial use, particularly in solar panels and electronics. However, given the current forecasts, strategies should be cautious andaligned with broader market trends.

Copper Predictions and Strategies

Copper prices are expected to fluctuate due to strong demand driven by economic growth and clean energy transitions. Some experts suggest that copper prices need to double to incentivize new mining projects to meet future demand. Given the strong demand and potential for price increases, investors might consider copper as a strategic investment. However, volatility due to tariff uncertainties and global economic conditions should be factored into investment decisions. Long-term investors may want to focus on the potential for copper prices to rise as demand for clean energy technologies increases.

And remember:

- Diversify your portfolio to mitigate risks associated with commodity price volatility.

- Keep abreast of global economic trends, tariff decisions, and geopolitical factors that can impact commodity prices.

- Adopt a long-term perspective, as both metals are subject to fluctuating demand and supply dynamics driven by technological advancements and economic growth.

Investors who are interested in diversifying their commodity portfolio in 2025 might find opportunities in silver and copper, as these metals have shown potential for even better prospects due to market inefficiencies and growing demand, particularly in the solar and electronics sectors for silver, and economic growth and clean energy transitions for copper. For instance, the World Silver Survey 2025 predicts a slight increase in silver production, while copper prices are expected to fluctuate yet potentially double to incentivize new mining projects. Nevertheless, it's crucial to keep a close eye on global economic trends, tariff decisions, and geopolitical factors that can impact commodity prices, and maintain a long-term perspective, as both metals are subject to demand and supply dynamics driven by technological advancements and economic growth.