Potential 5% decrease in TRON's value: Plausible weak demand could be the cause.

TRON's Challenges: What the Bulls Need to Overcome

- *Hop on the TRX rollercoaster

- TRX: Soaring high, crashing hard?

- Tweet this

**TRON [TRX] faces a fight to break past the mid-range resistance at $0.248 and sustain its upward rally. Here, we explore the challenges that TRX bulls need to conquer to ensure a bullish market structure.

## Navigating the TRX Tightrope

CoinGlass

source: TRX/USDT on TradingView

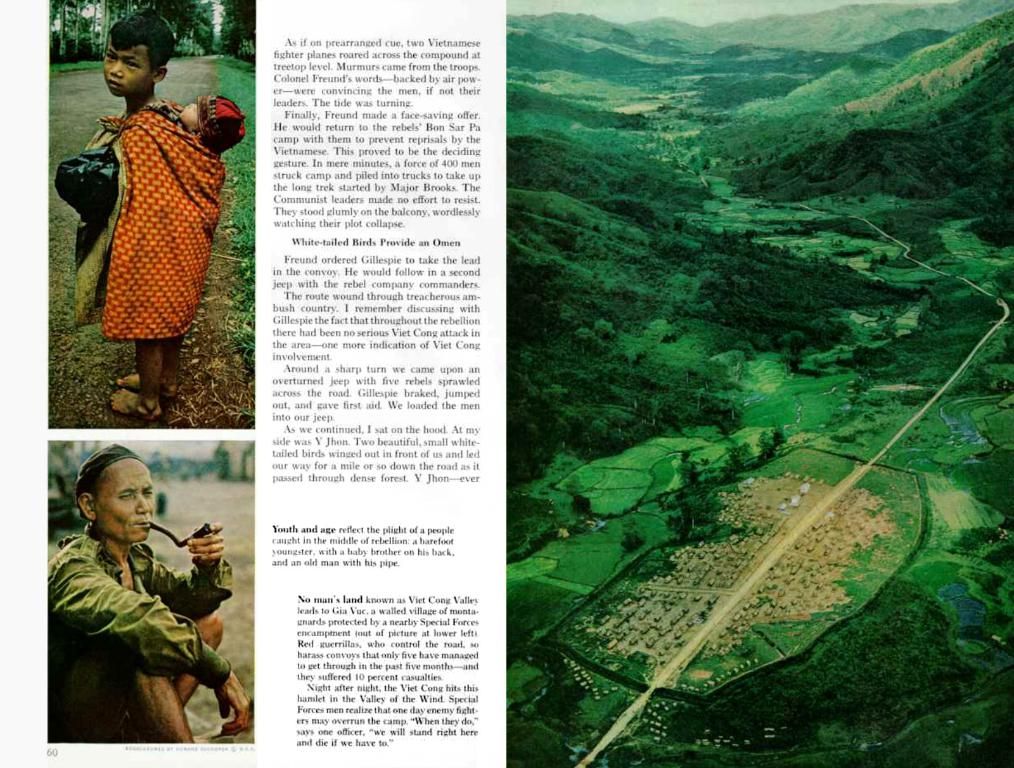

The mid-range resistance level at $0.248 has stood tall for three weeks, hindering the TRX bulls' attempts to flip it into support. This enduring obstacle illustrates the fragile state of TRX's momentum.

The daily relative strength index (RSI) has consistently hovered above the neutral 50 since mid-March, suggesting accumulating momentum. However, the lack of strong buying pressure is highlighted by the stagnant on-balance volume (OBV), which has been on a slow downtrend since mid-April.

The dwindling trading volume over the past three weeks points to a dominance of sellers. The absence of substantial demand might be a red flag for aggressive traders as the $0.252 and $0.255 local resistance levels loom.

## Watch Out for the Drops

CoinGlass

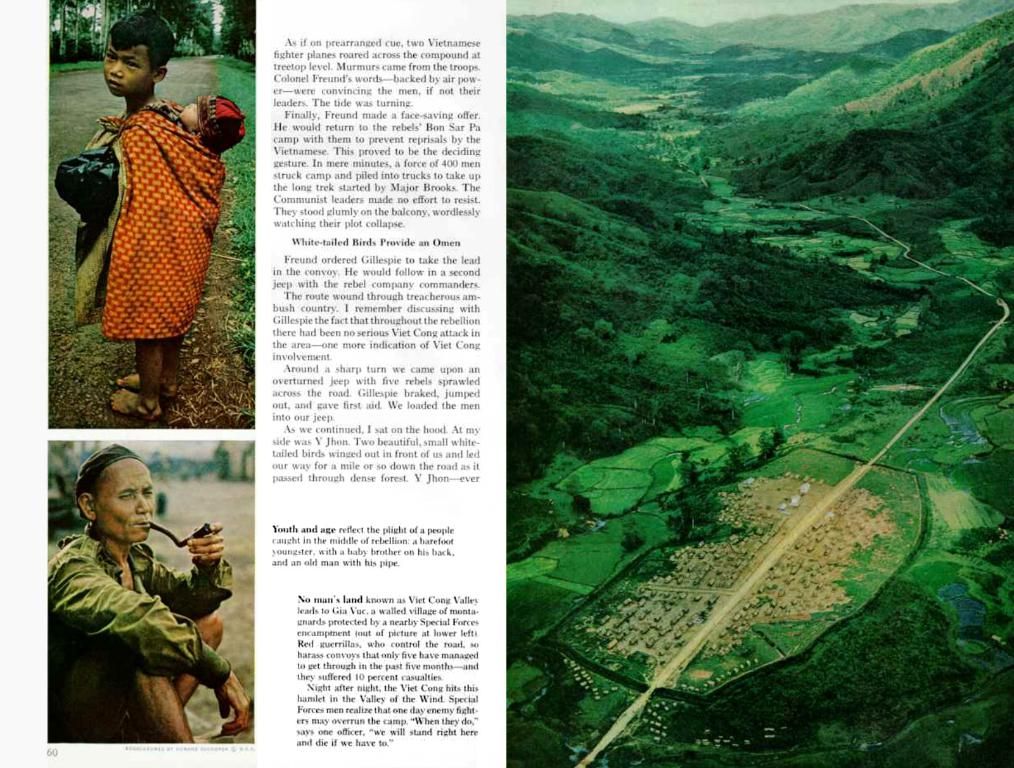

The liquidation map reveals high leverage liquidation levels close to price levels that traders should keep an eye on:

- $0.236 - $0.238: Watch out for heavy selling pressure at this zone; a drop here might offer a buying opportunity for savvy traders.

- $0.256 - $0.258: This zone represents a resistance level with a chance of rejection; traders will want to be cautious if this level is tested in the coming days.

A potential test of the $0.236 level may lead to a deeper correction, but the higher cumulative liquidation leverage here suggests a strong pull toward this level.

## Enrichment Data Insights

- Price Volatility: With a volatility of 1.86% over the last 30 days, TRX faces challenges in maintaining a consistent upward trend[2].

- Predicted Price Drops: Analysts predict TRX could drop to $0.227303 by May 14, 2025 (11.18% decrease)[4]; another prediction suggests it could fall to $0.176651 by June 10, 2025[2].

- Market Sentiment: Although the sentiment is currently bullish, with a Fear & Greed Index at 70 or 73, indicating greed[2][4], it can change rapidly.

- Key Price Levels: Important resistance levels stand at $0.259587, $0.262516, and $0.268034; critical support levels include $0.251140, $0.245621, and $0.242692[4].

As TRX bulls strive to maintain their upward rally and navigate through potential price drops and volatility, the high-stakes game continues to unfold. May the odds be ever in your favor.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer's opinion.

Take a Survey: Win $500 USDT Is Shiba Inu destined to be the Doge Killer? Here's why SHIB could outperform DOGE in 2023#### Share

- Share

- Tweet

- The current resistance at $0.248 for TRX, poses a significant challenge for TRX bulls to break and ensure a sustainable upward rally.

- Market analysts predict drops in TRX prices, with a potential fall to $0.227303 by May 14, 2025, and another predicted drop to $0.176651 by June 10, 2025.

- Bitcoin and other alternative cryptocurrencies (altcoins) such as Ethereum (ETH) and its token (ETH), are often at the forefront of advancements in technology and finance, making them integral parts of the investing world.

- The fragile momentum of TRX is highlighted by the stagnant on-balance volume (OBV) and the lack of strong buying pressure, giving an edge to sellers and suggesting a possible red flag for aggressive traders.