Ethereum's Breakout and Consolidation: A Bullish Scenario

Possible reason for Ethereum (ETH) price increase in the near future

Check out our nifty breakdown on the latest Ethereum (ETH) happenings!

Table of Contents

- The Rise and Consolidation of Ethereum

- Technical Indicators: A Bullish Forecast

- Institutional Interest: BlackRock's Ethereum Purchase

- Upcoming Price Predictions

The Rise and Consolidation of Ethereum

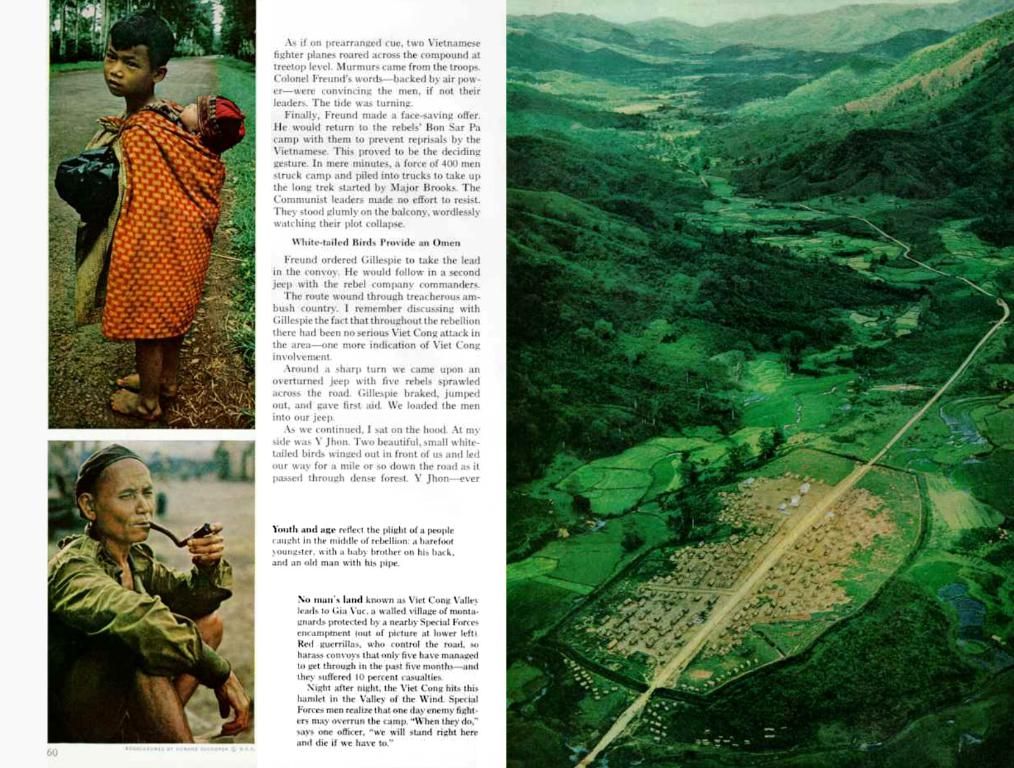

After breaking out of a falling wedge, Ethereum is currently consolidating above its 200-day moving average, hanging tough at around $2,680. This stable position showcases Ethereum's strength above major support at $2,680.

Techncial Indicators: A Bullish Forecast

Analyst Captain Faibik highlights an interesting chart pattern – Ethereum's breakout from a falling wedge on its daily chart. This event lifted Ethereum above its 200-day moving average, indicating potential for upward movement.

The consolidation zone near $2,800 continues to act as resistance, but the market seems to be gathering momentum. If Ethereum manages to hold above $2,680, traders are anticipating a resurgence of bullish momentum.

Institutional Interest: BlackRock's Ethereum Purchase

In a bullish twist, BlackRock has been beefing up its Ethereum holdings, going from $1.42 billion to $3.71 billion since early May, without selling a single ETH. This sustained accumulation adds weight to the prospect of Ethereum's price surge.

Upcoming Price Predictions

With a combination of solid technical patterns and strategic institutional investments, traders are watching for Ethereum to make a move toward the alluring $3,000 zone.

However, it's important to keep an eye on potential downside risks – macroeconomic headwinds, for one, could dampen crypto markets and put a damper on Ethereum's price trajectory. In such a scenario, Ethereum might dip down to the $2,280 level.

Remember, these predictions are just speculative and subject to change with market swings. Always do your own research or consult a financial expert before making investment decisions!

[1] Captain Faibik's crypto analysis – https://youtu.be/Ymg1M0YqMDg[2] CoinGecko data – https://www.coingecko.com/en/coins/ethereum[3] Major support and resistance levels – https://coin360.io/chart/ethereum/usd[4] June 2025 Ethereum price predictions – https://cryptoranker.com/ethereum-price-prediction[5] Fibonacci retracement levels – https://www.tradingview.com/chart/?symbol=ETHUSD&interval=3D

- In the realm of finance, the escalating institutional interest in Ethereum is evident, with BlackRock amassing a significant holding of Ethereum (ETH), amounting to $3.71 billion as of early May, without any sell-offs, strengthening the case for Ethereum's potential price surge.

- Not only has Ethereum broken out from a falling wedge, thanks to the technical expertise of analyst Captain Faibik, but it is also consolidating above its 200-day moving average at approximately $2,680, demonstrating its strength above a major support level.

- The financial landscape of technology-focused digital assets, such as Bitcoin and Ethereum, is filled with speculative predictions, including the expectation that Ethereum may steal the spotlight by making a move towards the attractive $3,000 zone, based on promising technical patterns and strategic institutional investments. However, it's crucial to be aware of potential downside risks, such as macroeconomic headwinds, which could impact the crypto markets and cause Ethereum's price to dip down to the $2,280 level.