Museum and Impact Initiative Introduce Biodiversity Data Analysis Tool

In a groundbreaking collaboration, GIST Impact, a climate data analytics firm backed by UBS, and the Natural History Museum have joined forces to integrate the Biodiversity Intactness Index (BII) into GIST Impact's analytics platform. This partnership aims to equip institutional investors with biodiversity data, enabling them to assess and reduce their impacts on nature more effectively.

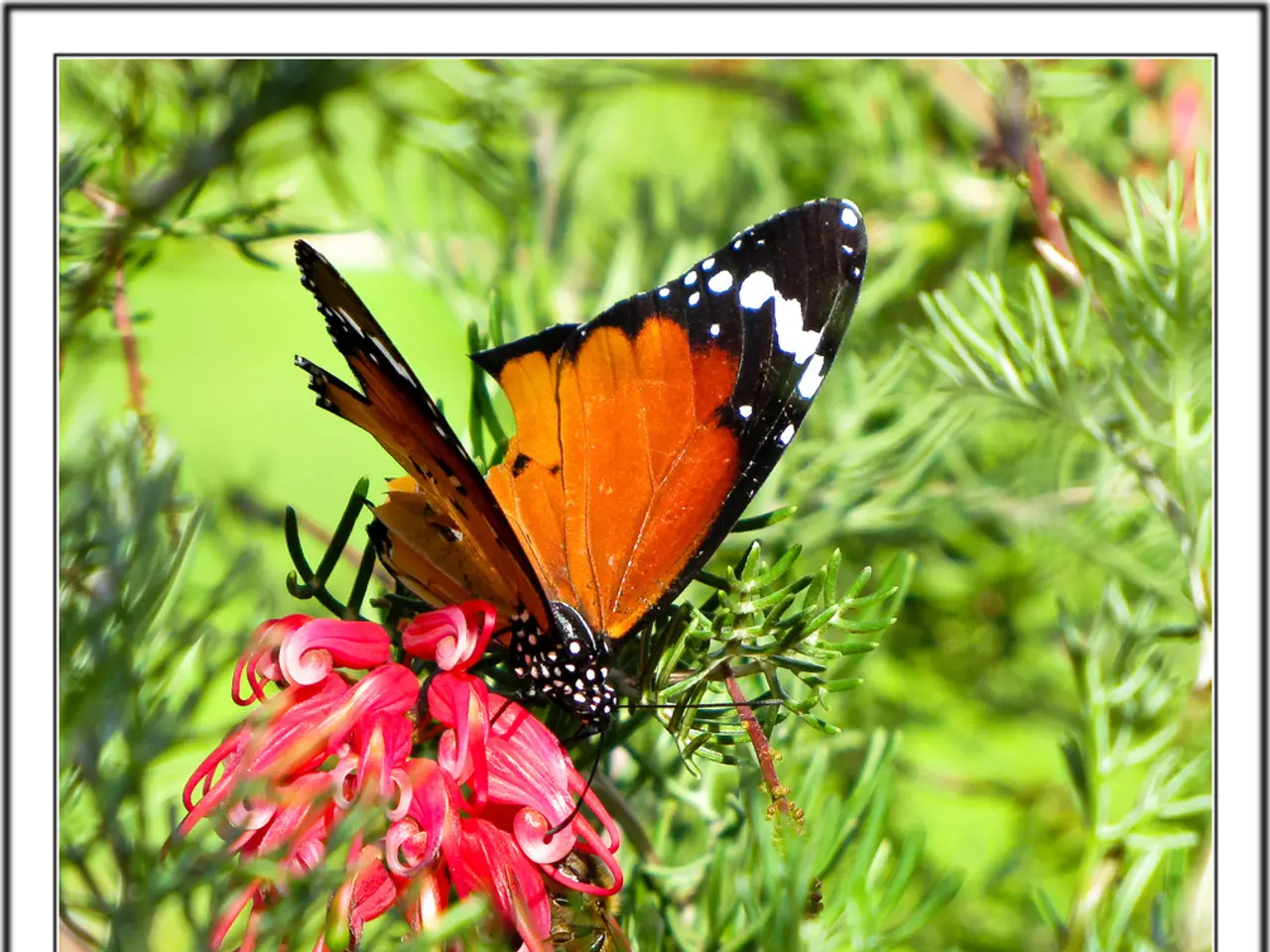

The BII, developed by researchers at the Natural History Museum, is a measure of ecosystem health that tracks how biodiversity is affected by human activity such as land use change and intensification. By incorporating the BII, GIST Impact can provide site-level biodiversity insights for more than 98% of global listed companies and millions of private firms.

This integration significantly enhances institutional investors' ability to assess nature-related risks in global corporate assets with greater precision and ecological relevance. Key impacts include improved biodiversity risk metrics, greater ecological context, enhanced decision-making on sustainability, facilitating risk screening and scenario analysis, and the ability to model potential nature-positive outcomes.

With BII data, investors can better integrate biodiversity impacts into environmental, social, and governance (ESG) frameworks, improving stewardship and guiding capital allocation away from nature-degrading practices. The Natural History Museum’s BII is recognized globally and provides scientifically robust data supporting these assessments.

Pavan Sukhdev, founder and CEO of GIST Impact, stated that nature-related risks are translating into material financial impacts. He emphasized that the collaboration aims to equip investors with the tools necessary to navigate these risks and make more informed, sustainability-aligned investment decisions.

Doug Gurr, director of the Natural History Museum, supports GIST Impact's global reach as an ideal partner to help bring the BII into investment decision-making. He believes that this collaboration will help drive a more sustainable future by encouraging investors to consider the ecological impacts of their investments.

The collaboration was announced on 1st July, and the platform is now live, allowing investors to assess financial exposure to declining ecosystem health, screen assets for biodiversity risk, and model potential nature-positive outcomes. As investors face increasing expectations to measure and disclose nature-related impacts, this partnership is expected to play a significant role in shaping the future of sustainable investing.

- The Biodiversity Intactness Index (BII), a measure of ecosystem health developed by researchers at the Natural History Museum, will be integrated into GIST Impact's analytics platform, providing site-level biodiversity insights for over 98% of global listed companies and millions of private firms.

- By incorporating the BII, institutional investors can access biodiversity data that enables them to assess and reduce their impacts on nature more effectively, improving biodiversity risk metrics, providing greater ecological context, and enabling enhanced decision-making on sustainability.

- With the BII data, investors can better integrate biodiversity impacts into environmental, social, and governance (ESG) frameworks, improving stewardship and guiding capital allocation away from nature-degrading practices, ultimately driving a more sustainable future by encouraging investors to consider the ecological impacts of their investments.