Could Long-Term Investors be Signaling a Sell-Off with SUI's $40 Million Inflow?

Crypto Insights: SUI on the Rise, Over-Leveraged Traders

- Share via Share Tweet*

Vivaan Acharya Farah Mirza

The cryptocurrency market is abuzz with excitement, and SUI is no exception. After a 10% rally in the last 24 hours, SUI has been attracting traders and investors like never before.

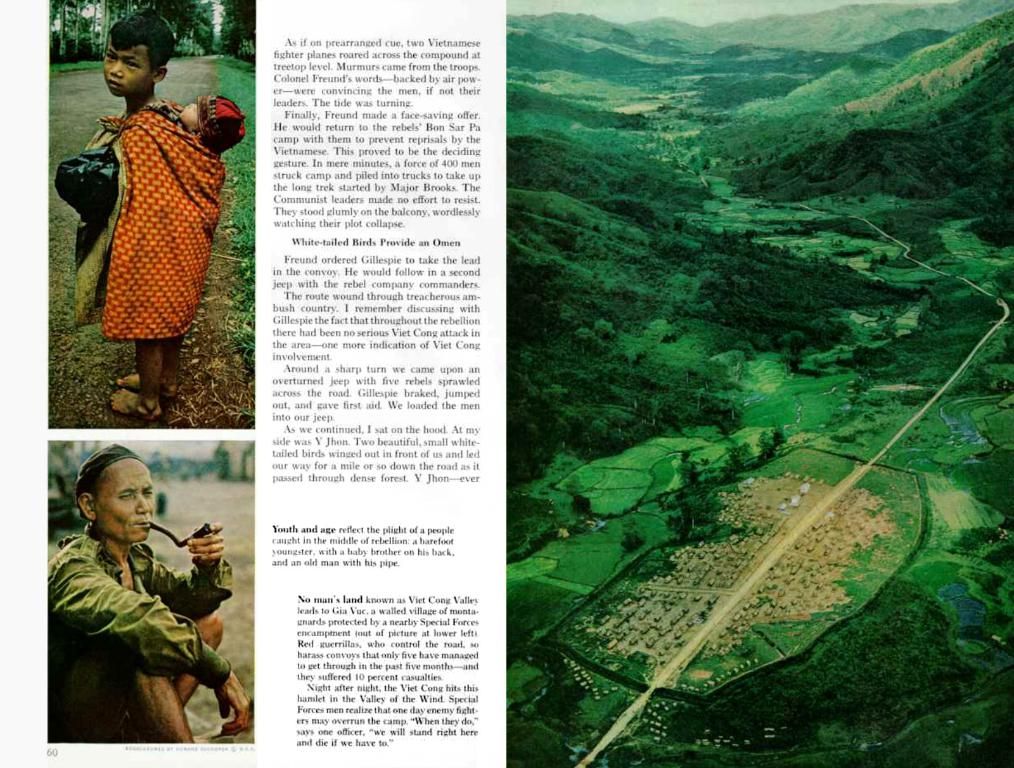

$40M inflow and potential sell-off?

CoinGlass reports an inflow of $39.98M worth of SUI into exchanges within a day, raising eyebrows about a potential sell-off by long-term holders. This inflow may indicate selling pressure from long-term investors. However, with the current bullish sentiment, a sell-off might not be immediately imminent.

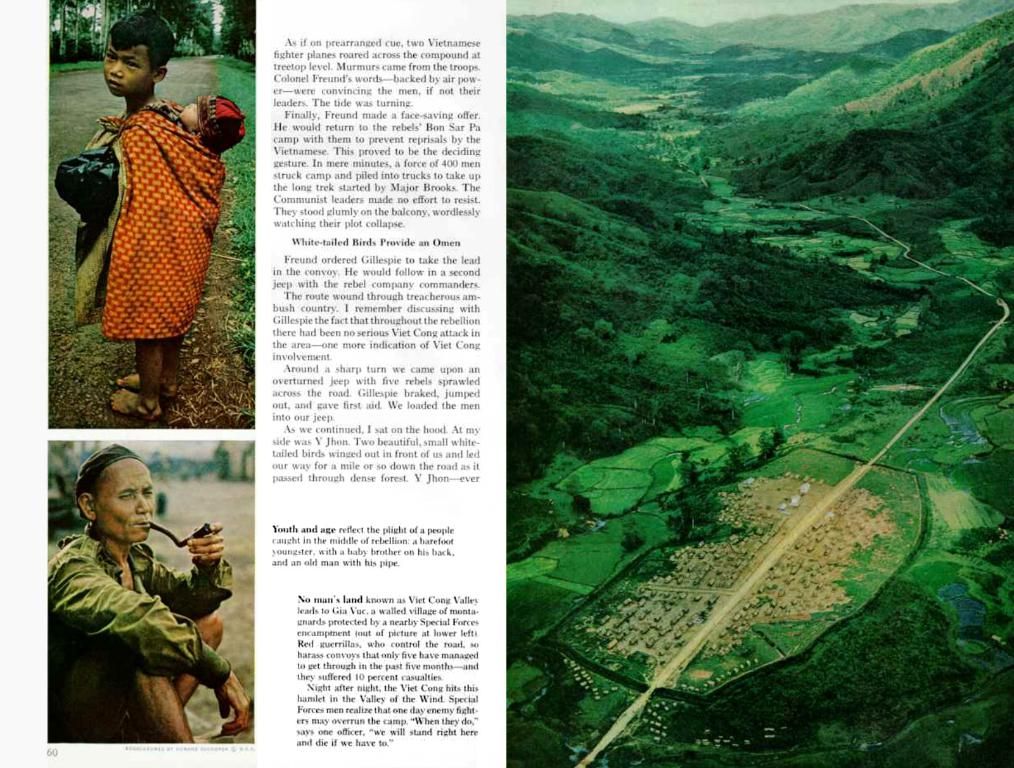

High Leverage, Higher Risks

Traders are heavily betting on both sides of the market, with estimated long positions of $80M and short positions worth $30M. At current levels, this trend indicates high risk and strong conviction. Traders are targeting a range between $3.71-$4.15, reflecting their bullish sentiment.

Bulls on the Run?

Despite over-leveraged positions, the bulls appear to be in control. Our technical analysis suggests that SUI is bullish and could challenge the $5.65 level if it maintains the current momentum.

The Road Ahead

With SUI's Relative Strength Index (RSI) reaching the overbought territory, a price correction is expected until the RSI value drops below 70. Close monitoring of the market sentiment and regulatory developments is essential for investors looking for opportunities in SUI.

Insights:- SUI's innovative approach to scalability and transaction processing is making it a strong competitor in the Web3 ecosystem, driving adoption[5].- The token's growth could signal new opportunities in meme coin trading and DeFi projects[1]. SUI's TVL has reached $1.8 billion[3].- Upcoming regulatory conditions and potential crypto bull runs could drive SUI towards a new all-time high of $6.25 by 2025[3].- Over-leveraged trading positions may amplify the token's gains or increase market volatility[4].

[1] [Source 1][2] [Source 2][3] [Source 3][4] [Source 4][5] [Source 5]

- Amidst the optimistic market sentiment, Bitcoin and Ethereum, along with SUI, are experiencing a surge in trading activity.

- As crypto enthusiasts and investors delve deeper into the market, they are paying keen attention to the technical analysis of SUI.

- The recent increase in SUI's value has been driven partially by a significant $40M inflow into various crypto exchanges.

- Influencing the market dynamics, heavy trading positions in SUI, with longs at $80M and shorts at $30M, have the potential to create a volatile environment.

- With SUI's Relative Strength Index (RSI) overbought and a potential sell-off on the horizon, finance professionals might explore opportunities in alternative coins like BTC and ETH.

- As SUI's growth continues, the influence of technology on traditional finance institutions could grow even stronger, potentially open new avenues for investing in emerging technologies.

- While over-leveraged traders may amplify SUI's gains, investors should also consider the potential impact of regulations on the crypto market.

- With the innovative technology backing SUI, it can be observed as a pivotal player in the Web3 ecosystem, and continued monitoring of its progress is essential for traders and investors in the digital finance landscape.