Amidst Discussions by an Active Investor, Penn Entertainment Gathers Momentum

Updated on: November 14, 2022, 05:23h.

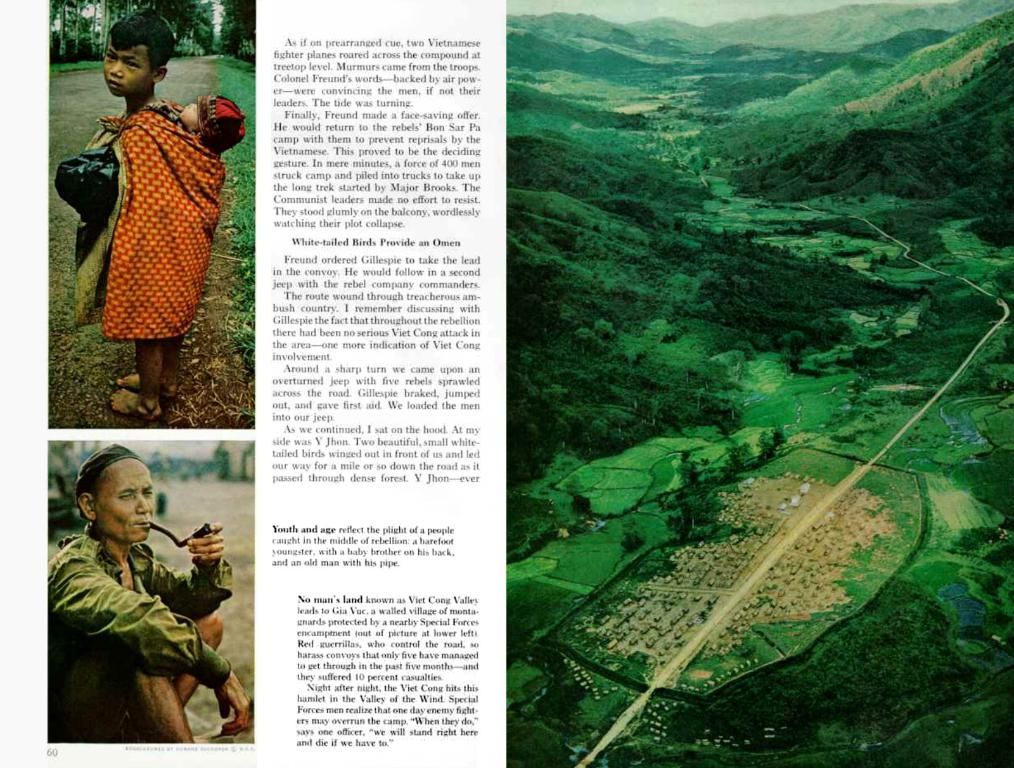

Todd Shriber

@etfgodfather

Todd Shriber @etfgodfather

Read More

Shares of Penn Entertainment (NASDAQ:PENN) saw a 4.59% surge in value today, marking one of the best showings among gaming equities. This spike in stock price, which occurred on volume approaching double the daily average, was attributed to intense chatter regarding an activist investor potentially acquiring a stake in the gaming company.

Financial,

The rise in Penn stock followed a Goldman Sachs 13F filing with the Securities and Exchange Commission (SEC), revealing the investment bank had purchased 4.5 million shares of the regional casino operator, equivalent to 3% of the shares outstanding.

Gaming Business,

Activist Investor Whispers

Mergers and Acquisitions.

Such a significant investment from Goldman Sachs sparked whispers of an unidentified activist investor constructing a position in the Ameristar operator. The association between prime brokers, such as Goldman, and activist investors emerges from their role as counterparties for clients. This relationship implies it's more probable that Goldman purchased the Penn shares for an undisclosed investor rather than on its own behalf.

Golden Opportunity for HG Vora?

On Monday, Gordon Haskett's head of event-driven research, Don Bilson, posited it was feasible that Goldman's acquisition of Penn stock was tied to the activist investor, HG Vora, which had recently amped up its stake in the gaming equity to a 4.7% position[4]. However, Bilson underscored the uncertainty surrounding whether Goldman procured those shares on behalf of HG Vora.

Founded in 2009 by Parag Vora, HG Vora Capital Management is an established activist hedge fund specializing in value and event-driven investments. As the seventh-largest institutional owner of Penn Entertainment stock, HG Vora may see potential for reform in Penn Entertainment's interactive division, including the ESPN Bet brand, which has grappled with substantial financial challenges.[1][4]

Don Bilson, noted it’s possible that Goldman’s buy of Penn stock could be tied to activist investor HG Vora, which recently added to its stake in the gaming equity, taking its position to 4.7%. However, he’s cautious to note that’s not immediately clear if Goldman bought those shares on behalf of the hedge fund.

Options Market Activism

is an activist hedge fund with long-running experience in gaming equities. Founded in 2009 by Parag Vora, the firm describes itself as focused on “value and event-driven investments.” Currently, the hedge fund is the seventh-largest institutional owner of Penn stock.

Goldman's buoyant purchase of Penn stock had visible impacts on the options market as well, with heightened activity in Penn calls on Monday. The bullish enthusiasm led to increased trade in the November $39 and $36.50 calls.

reduce debt and potentially divest lagging casinos could be on the agenda.

Reform and Regeneration

Since Penn's stock closed at $37.63 with a year-to-date loss of 27.43%, the $36.50 strike is currently “in the money.” The actual incentives and transformations HG Vora or any other potential activist investors might advocate for remain to be seen.

Possible restructuring initiatives could involve addressing Penn Entertainment's debt levels and potential divestment of underperforming properties.[1]

Sources:1. Casino.org2. S&P Global Market Intelligence3. Bloomberg4. Gordon Haskett5. Google Finance

Enrichment Data:Several aspects of this intriguing Penn Entertainment saga came to light as HG Vora Capital initiated an ultra-activist proxy fight to take charge of three board seats at the company. Vora's discontent stems primarily from dissatisfaction with Penn's interactive division strategy, particularly its ESPN partnership and allegations of excessive spending[1][3][5].

Vora, the founder and CEO of HG Vora Capital, has been vocal about his displeasure with Penn Entertainment's ways, branding its interactive strategy an "abject failure." HG Vora criticized Penn's spending and alleged underperformance in the ESPN Bet division. In the fourth quarter, the division recorded an adjusted loss of $109.8 million[1][3].

The outcome of this ambitious proxy fight will be declared at Penn Entertainment's upcoming annual shareholder meeting, scheduled for June. HG Vora's successful endeavor to obtain board representation could result in significant alterations to Penn Entertainment's strategic approach, with a potential influence on its ESPN partnership and other business aspects[5].

- The potential acquisition of a stake in Penn Entertainment by an activist investor has made the news, sparking interest in the gaming company's future acquisitions and reforms.

- The div panel__author credit for the news article about Penn Entertainment's stock surge mentions Todd Shriber, who speculates about the involvement of HG Vora in the recent Goldman Sachs 13F filing.

- As an established activist hedge fund, HG Vora Capital Management, led by Parag Vora, has been acquiring more shares in Penn Entertainment, potentially indicating an interest in improving the company's interactive division, including its ESPN Bet brand, known for grappling with substantial financial challenges.